To make informed decisions regarding a divorce settlement, it’s crucial to have a strong grasp of the different types of pension arrangements. This guide is intended to provide you with a basic understanding of these arrangements.

It’s important to note that this guide is not exhaustive and should not be treated as financial advice.

What types of pension arrangements are available in the UK?

Pension provision in the UK is made up of both State Pension and private provisions, either through an employer or an individual.

Private pensions typically fall into two categories:

- Defined Benefit (also known as Final Salary or Career Average Earnings (CARE))

- Defined Contribution (also known as Money Purchase)

Defined Benefit in Detail

What is a defined benefit scheme?

A defined benefit scheme offers a secure income for life, often increasing annually. It is based on an accrual rate, the number of years of pensionable service, and the pensionable salary earned during that time. These schemes are commonly referred to as Final Salary or Career Average Revalued Earnings (CARE) schemes.

Who has this type of pension arrangement?

These pensions are generally offered by large UK employers or public sector organisations, such as the NHS, teachers, and police force.

Are the benefits based on how much I have paid?

No, the benefits of defined benefit schemes are not tied to the amounts paid by the employee or employer. While employees typically contribute between 2% and 5% of their salary, the employer contributes significantly more to ensure there are sufficient funds to pay pensions upon retirement.

How is the pension calculated?

The pension is calculated using an accrual rate—commonly 1/60th or 1/80th of pensionable salary for each year of service.

Example:

If Matt retires at 65 after 20 years of service on a £30,000 salary, his pension will be calculated as:

20 (years) x £30,000 (salary) ÷ 60 (accrual rate) = £10,000 annually

This amount is referred to as a Scheme Pension.

When does the pension become payable?

Defined benefit pensions generally become payable at the scheme’s normal retirement age, typically between 60 and 65, or the state pension age in public sector schemes.

Can I retire early?

This depends on the scheme. Some allow early retirement (usually from age 55 which is known as early retirement. This will increase to 57 from April 2028), but the pension amount may be reduced by 3% to 6% for each year of early retirement. It is possible to take benefits without retiring.

Can I defer taking my pension?

Many schemes (though not all) allow you to defer taking your pension beyond the normal retirement age, possibly increasing the benefits for late retirement.

How secure is the pension?

Defined benefit pensions are payable for life and typically increase annually. In the event of the employer’s insolvency, the Pension Protection Fund may offer compensation, subject to specific conditions.

What benefits are payable if I die?

If you die after retirement, your pension may continue to be paid to a spouse, civil partner, or dependent. A lump sum could also be paid if death occurs within five years of retirement.

Can I take a tax-free lump sum?

Some schemes provide a tax-free cash sum in addition to the pension. Others allow members to exchange a portion of their pension (typically up to 25%) for a tax-free lump sum, known as commutation.

If my ex-spouse’s pension is in payment, can I withdraw a tax-free lump sum from the pension credit?

No, if the pension is already being paid out, you are not eligible to take a tax-free lump sum yourself.

Where can I find more information about my pension scheme?

Each pension scheme should provide a booklet or guide explaining its rules and operations. This document is a helpful resource for answering common questions about the scheme.

The scheme is typically managed by trustees and governed by a set of legal rules. These documents are detailed and generally not referred to by members unless there is a dispute.

You should also be able to request a member’s statement, which will show the benefits you have accumulated so far.

I think I have a defined benefit pension but don’t know who manages it—how can I find out?

If you’ve lost track of a defined benefit scheme, the Pension Tracing Service can assist you in locating the current administrator of the scheme. Visit: www.gov.uk/find-lost-pension.

What considerations should I have during a divorce?

Due to legislative changes over the years, defined benefit schemes can be complex, with different benefits for different service periods.

This summary provides only a general overview, and it’s crucial to gather detailed, specific information when dealing with pensions during a divorce.

You may need a shadow expert to help formulate questions for a pension report for court proceedings. These are services we at MKC Professional Services can offer.

It’s important to understand that the cash equivalent value (CEV) of a defined benefit scheme in a divorce might not represent the true cost of securing an alternative pension income via an annuity or for offsetting purposes.

For example, if the CEV is £200,000 and the family home is also valued at £200,000, splitting so that one person keeps the house and the other keep the pension is unlikely to be fair.

A comprehensive pension report is likely required for the court to properly assess how to divide pension benefits fairly between both parties.

Defined Contribution Pensions in Detail

What is a defined contribution scheme?

Defined contribution schemes accumulate a pension pot through contributions made by you, your employer, and investment returns. These funds are then used to provide either lifetime income or cash lump sums, part of which may be tax-free.

These schemes are also referred to as money purchase arrangements.

What types of defined contribution schemes are there?

- Personal Pensions

- Stakeholder Pensions

- Section 32 Buyout Plans

- Additional Voluntary Contributions (AVCs)

- Free Standing AVCs

- Executive Pension Plans

- Group Personal Pension Plans (GPPs)

- Self-Invested Personal Pensions (SIPPs)

- Small Self-Administered Schemes (SSAS)

You may recognise some of these terms from the pensions information you have available.

How much will I receive when I retire?

The amount you receive depends on:

- The size of your pension pot, which is influenced by how long you’ve saved, how much you and/or your employer contributed, and the investment performance.

- Your retirement choices, such as the type of income you want and its frequency.

- How much tax-free cash you decide to take.

- Annuity rates at the time, if applicable.

- Fees and charges taken out of your pension by your provider.

What contributions can be paid into a personal pension?

Contributions to a personal pension can be made in several ways:

- Regular monthly or yearly contributions by you or your employer.

- Single lump-sum contributions at any time.

- Transfers from other pension arrangements to consolidate your pension savings, if appropriate.

If you’re awarded a pension sharing order, the pension credit is likely to be transferred to a personal pension unless ‘shadow membership’ is an option.

Where are my contributions invested?

Your contributions are invested in a range of funds, which are selected based on your personal circumstances and preferences.

These decisions depend on factors like the time horizon for your investments and your risk tolerance. Regular reviews of your investment strategy are essential, and MKC can assist with a comprehensive review.

Do I need to retire to start taking benefits?

No, you don’t have to stop working to draw your pension benefits. However, it’s important to consider the tax implications of receiving pension benefits alongside earned income.

When can I retire and access my pension?

You can typically start using your pension pot from age 55, although this will increase to 57 from April 2028.

What are my options when I take benefits?

You have several options, including:

- Taking your entire pension pot as a lump sum, with 25% tax-free, and the rest subject to income tax.

- Withdrawing lump sums as needed, with 25% of each lump sum tax-free and the balance taxed.

- Taking 25% of your pension pot as a tax-free lump sum, then using the rest to provide a regular taxable income.

- Taking 25% tax-free, then converting the rest into a lifetime annuity.

If my ex-spouse’s pension is in payment, can I take a tax-free lump sum from the pension credit?

No, if the benefits are already in payment, you are not eligible to take a tax-free lump sum from the pension credit.

What is an annuity?

An annuity is a financial product that provides a guaranteed income for life, purchased using funds from a defined contribution pension scheme.

If you are a member of such a scheme, this product offers a ‘lifetime annuity.’

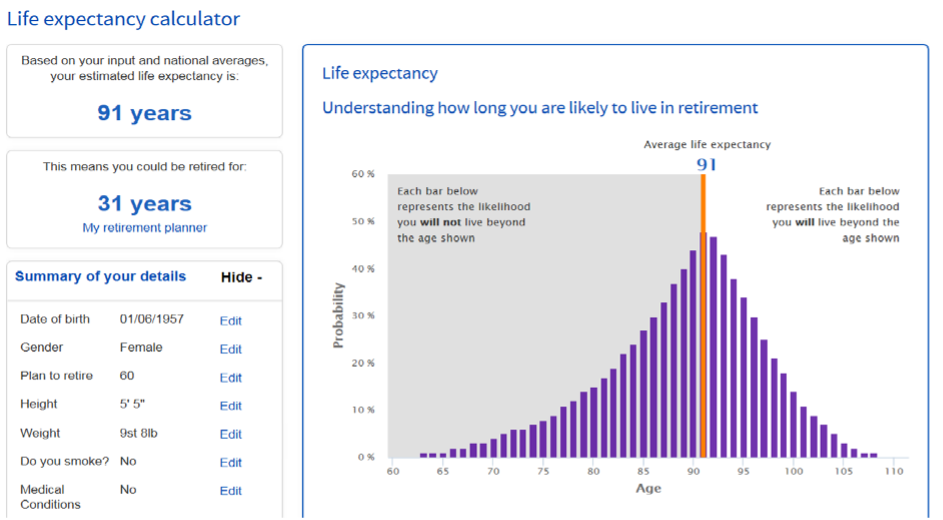

It’s crucial to consider how long your pension will be payable. Many people underestimate their life expectancy, so it’s important to plan accordingly.

The chart below shows that if you believe that on retirement at age 60 that your life expectancy will be 84, then in fact you have as much probability to survive to age 97.

Lifetime annuity can only be purchased with the proceeds of a money purchase pension scheme

How flexible is an annuity?

An annuity offers a range of options that allow you to tailor how and when you receive your income. However, each decision you make will influence the total amount you receive. The options include:

- Payment Frequency

You can choose how often you receive payments, typically monthly, though some providers may offer quarterly or yearly options. - Annual Increases

You can opt to have your payments stay the same or increase each year. These increases can be set at a fixed percentage or linked to inflation, such as the Retail Prices Index (RPI), ensuring that your income keeps pace with the cost of living. - Death Benefits

You can arrange for your annuity to continue paying an income to your spouse, civil partner, or other dependents after you pass away, in exchange for a smaller pension during your lifetime.You can also select a guaranteed payment period—commonly 5 or 10 years—where, if you die during this period, payments continue to your beneficiaries or estate until the end of the guaranteed term.It’s essential to understand that once your annuity starts, it becomes fixed. You cannot cash it in, switch providers, or temporarily stop payments.

How much will my annuity be?

Several factors determine the amount of income your annuity provides:

- The size of your pension fund at the time of purchase

- Your residential postcode, which can influence life expectancy assumptions

- Whether you smoke

- Any relevant health conditions

- Your age when purchasing the annuity

- The specific options you select, such as payment frequency or death benefits

- Current annuity rates at the time of purchase

What tax is payable on my annuity?

Annuity payments are subject to income tax under the Pay As You Earn (PAYE) system. HMRC will notify your annuity provider of your tax code, determining the amount of tax to be deducted. The rate of tax depends on your personal income circumstances, and you’ll be taxed at the basic, higher, or additional rate depending on your total income.

What is income drawdown?

Income drawdown allows you to take an income directly from your pension fund while the rest of the fund remains invested. This option provides more flexibility compared to an annuity, as you can adjust the amount of income you take, subject to available funds.

Do I need to use all of my pension fund at once?

No, you don’t have to use your entire pension pot for income drawdown. You can decide how much to withdraw based on your income needs, leaving the remaining funds invested.

When can I start using income drawdown?

You can typically access your pension fund for drawdown from age 55 (increasing to 57 from April 2028). Not all pension products offer drawdown, so you may need to transfer your pension fund to a provider that offers this option.

How can I use income drawdown?

You can take benefits in various ways, including:

- Regular tax-free cash payments

- Lump-sum tax-free cash payments

- Regular taxable income payments

- One-off taxable income payments

- A combination of these options

Since April 2015, drawdown has become more flexible, allowing you to withdraw as much as you need at any time. However, keep in mind that any income taken above your tax-free cash entitlement will be taxed at your highest marginal rate.

Once all your tax-free allowance has been utilised, any additional withdrawals will be considered taxable income. It’s also worth noting that tax-free lump sums and taxable income payments can be adjusted as needed throughout the duration of your plan.

However, income drawdown may not be the best option for everyone. Withdrawing too much income too quickly can risk depleting your funds prematurely, so it’s highly recommended that you consult with a financial adviser before making any decisions.

How is my income taxed?

If you opt to fully cash out your pension fund in one go, be aware that you could face a higher tax rate upfront.

This occurs because your pension provider may not have the correct tax code, and HMRC mandates that tax be deducted at an emergency rate.

In some cases, you may need to reclaim overpaid tax from HMRC, or alternatively, you could owe more tax if the initial deduction was insufficient.

Can I continue to contribute to a pension once I start income drawdown?

Yes, you can still contribute to a pension after starting income drawdown. However, contributions may be limited by the Money Purchase Annual Allowance, which caps the amount of contributions that qualify for tax relief at £10,000 annually.

Can I change from income drawdown to an annuity?

Yes, if you choose income drawdown initially but later decide you want the certainty of a guaranteed income, you can purchase an annuity at any time. However, once an annuity is in place, you cannot revert to drawdown.

What happens if I die while in income drawdown?

If you pass away while using income drawdown, the remaining value of your plan will typically be paid to your nominated beneficiaries, such as a spouse, civil partner, or dependents. The specific treatment depends on your age at death:

- Before age 75

Your beneficiaries can choose to:- Take the remaining fund as a tax-free lump sum

- Use it to buy an annuity

- Leave it invested to draw an income, all tax-free.

- After age 75

Your beneficiaries can choose to:- Keep the fund invested and take an income,

- Purchase an annuity,

- Take the remaining value as a lump sum

All options will be subject to income tax based on the recipient’s tax band.